There are several ways to see your inventory value in our system.

To see the inventory value you have in stock today, just do the following:

Click on Statistics

Click on Inventory (in the top right corner)

Inventory value is shown in the first box on the page

Inventory value is calculated as quantity * cost price. Be aware that you need to have stock and a cost price on the products for it to be able to calculate anything.

In connection with e.g. annual accounts, balance sheet, etc. it can be useful to pull a list of your inventory.

To make an export of the value of your inventory on a daily basis, go to Kassen and in the top right corner select Dagsopgørelser.

Then you just click on the day you need your inventory value from and read the line “Samlet lagerværdi (kostpris eks. moms)”.

This way you can always find the value of your inventory after the day’s sales, or the date you want the inventory value from.

If you need a list of all the products you have in stock, it has to be pulled at the time you need the list – this could be after the last opening day of the year, e.g. 31 December.

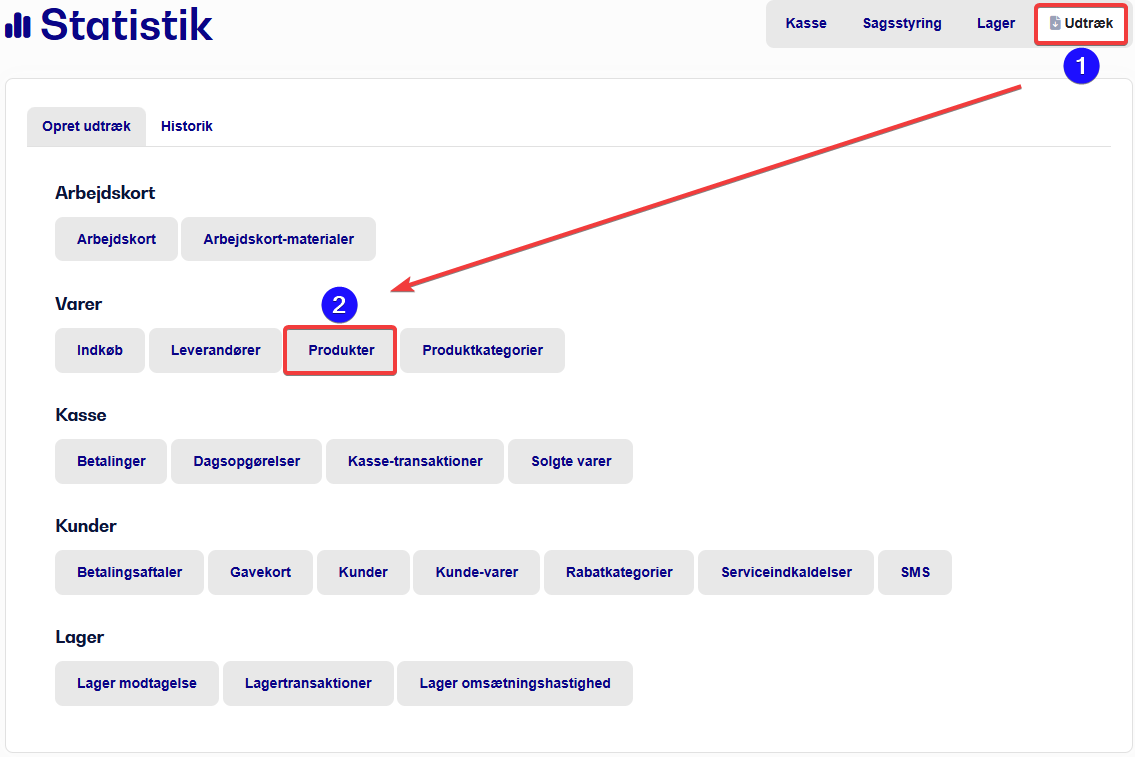

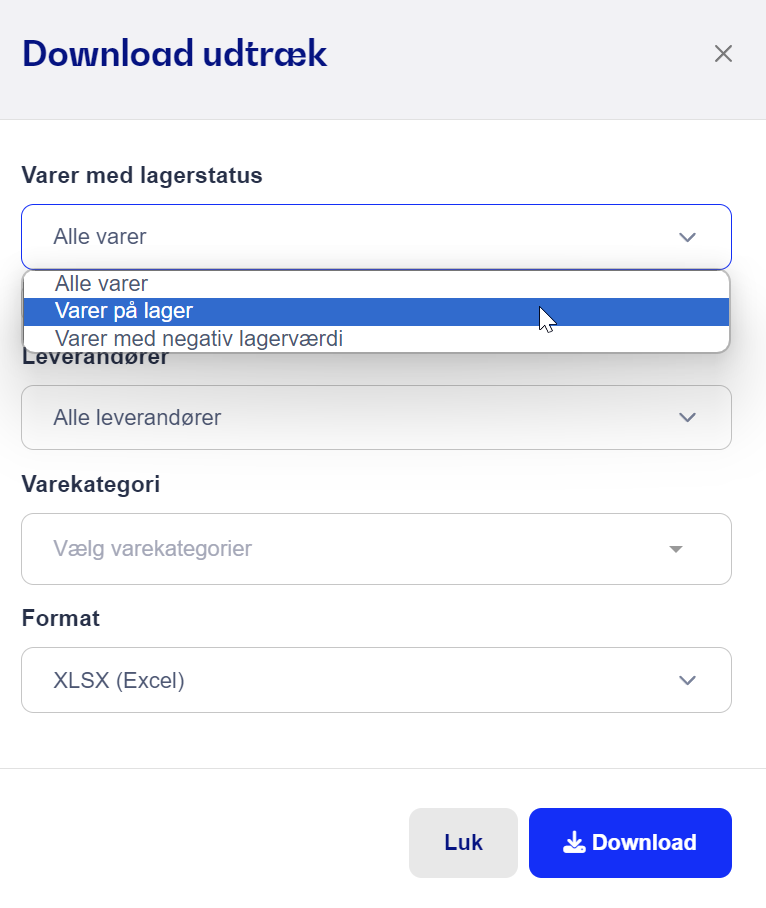

To pull the list, go to Statistik and under "Udtræk" you can pull a list of the products you have in stock. First you select the export Produkter and then you can choose Varer på lager via the drop-down menu.

After this, you can choose the file type you need – the default is XLSX (Excel), which gives you a file you can open in Microsoft Excel.

It’s important that you make sure to do this right after the daily report has been run on the day or before transactions are made the next day.

In this file, you can see how many units you have in stock of each item, as well as what the value of each item line is. You’ll find this under "stockvalue". Under total, you’ll be able to read the total stock value under "stockvalue"

You can, but for stores created after 2022, not all products will be included in the export.

It is therefore important that you make sure to pull an inventory list, for example on December 31, if you need it in connection with closing the annual financial statements