If you buy used bicycles, phones, or other products and resell them to your customers, VAT must be paid on the profit. This requires a specific setup for second-hand goods so that margin scheme VAT can be separated from standard VAT.

When you create a product, you can specify that it is a used item being resold for profit. This means the VAT will be calculated based on the profit margin instead of the sales price.

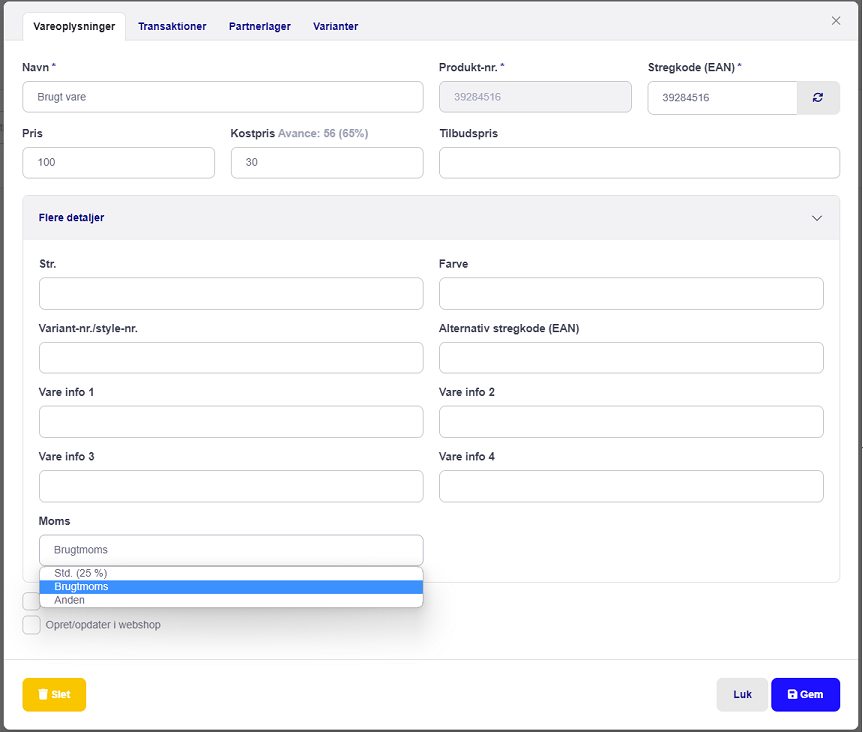

When creating a product, you can enable margin scheme VAT for that item.

To do this, click on the specific product and go to "More details..." → VAT → set it to Margin Scheme VAT, and then click Save.

Note: Make sure to enter both a sales price and a cost price for the item, as these are required to calculate the margin scheme VAT.

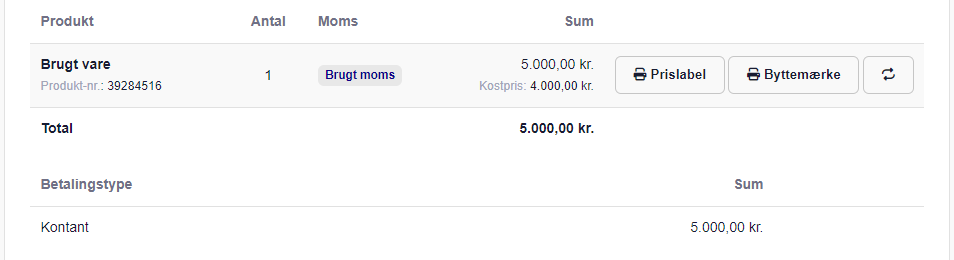

The store purchases a used item for 4,000 DKK.

The store sells the item for 5,000 DKK (incl. VAT).

VAT is only paid on the difference (the profit).

Since the profit is 1,000 DKK, the margin scheme VAT will be 200 DKK.

On the actual sale, it will be indicated if the item has been sold using margin scheme VAT.

We recommend using margin scheme VAT, as it simplifies both the product setup and the sales process.